WEBINAR: This webinar explores how to measure and communicate your organization's social impact with proven frameworks and strategies that matter to stakeholders.

Companies Supporting Financial Literacy & Financial Wellness

April is Financial Literacy Month—the perfect time to profile BCCCC member companies who are working to support financial literacy and financial wellness among their stakeholders. We recently spoke to leaders from Vanguard’s Community Stewardship Team—who developed a free, experiential classroom management system that teaches students financial responsibility —and Lincoln Financial Group—whose Lincoln Financial Foundation provides funding to promote financial security in three key focus areas: financial wellness, youth education, and critical human services programs. Continue reading for a closer look at these companies’ important community initiatives. But first, a bit of context on this subject…

What is financial literacy?

Financial literacy is a working knowledge of money-related concepts and skills. At the everyday level, this includes, for example, the ability to create and manage a household budget, maintain checking and savings accounts, understand compound interest—how money grows over time—along with credit, debt, interest rates, and personal insurance products. Financial literacy also encompasses the knowledge necessary for longer-term financial strategy—like investing, student loan borrowing, planning to purchase a home, and saving for retirement.

Although everyone needs money in our society, not everyone knows how to use it effectively. And the consequences of financial illiteracy can be very expensive. America’s financial literacy rate has fallen 19% over the past decade. The resulting cost, in 2020 alone, is estimated at somewhere around $451 billion.

Why is financial literacy important?

Just as traditional literacy—the ability to read and write—is a major determinant of success in life, financial literacy is shown to have “significant predictive power” over future financial outcomes. Financially literate individuals are more likely to spend less than they earn, save for the future, and make other choices that help prevent against what FINRA (the Financial Industry Regulatory Authority) terms “financial fragility.”

Beyond dollars and cents, some research draws connections among financial wellness, mental, and physical health. Financial stress may negatively affect a person’s wellbeing—especially for those in younger age groups, according to the FINRA Foundation’s National Financial Capability Study. A whopping 69% of respondents aged 18-34 reported that their personal finances are a source of anxiety. More than half think about money—in an unhappy way—at least once a day.

The demographics of financial literacy

Despite the benefits of developing financial literacy, not everyone has the opportunity. For a host of reasons, financial literacy gaps exist between different demographics. Worldwide, men outpace women in terms of average rates of financial literacy. Socioeconomic status, education level, and race can all play a role, too. According to the National Center for Education Statistics (NCES), Asian and White students have higher financial literacy scores than the overall U.S. average, while Black and Hispanic students’ scores fall below the national average.

Lincoln Financial recently released its 2024 Financial Concerns Report, highlighting the different financial concerns across every generation. While each generation was shown to have unique concerns aligned to their stage of life, one of the common threads uncovered was the concern of dealing with financial crisis, the “what if” scenarios. Gaining the knowledge to plan for and react to financial crises can build financial resilience. Lincoln says it’s committed to helping clients, employees, and communities achieve that goal.

Informing its financial literacy efforts, Vanguard cites an American Council on Consumer Interests study, which reveals that more than half of surveyed college students (52.9%) reported feeling “not at all confident about their knowledge of credit.” Almost 90% of the sample were either not at all confident (42.3%) or uncertain (46.3%) about their ability to manage credit.

“Vanguard believes our responsibility as long-term investors extends to the neighborhoods in which we live and work. We are committed to strengthening local communities through the strategic integration of philanthropy, inspired employee volunteerism and company expertise,” shared Aldustus (A.J.) Jordan, Head of Community Stewardship at Vanguard. “We help improve financial literacy knowledge gains and behavior changes among our young people by ensuring that My Classroom Economy is accessible and free of charge. We offer the program in two formats—printed and shipped paper kit and a digital experience—so all classrooms, no matter their access to technology, can participate and reap the benefits.”

Why help to build/teach financial literacy and financial wellness?

A number of states now require public high schools to teach financial literacy, but only seven of them actually earned an A grade from Champlain College’s Center for Financial Literacy, as recently noted by The New York Times.

“Financial wellness programs do more than simply build financial literacy. They provide individuals the knowledge and resources needed to make informed decisions and achievable goals for long-term success,” explained Meghan Wright, Vice President and Executive Director, Lincoln Financial Foundation.

“Having the knowledge to face both opportunities and challenges with confidence enables individuals to build the resilience needed to withstand financial roadblocks and plan for the future. When individuals achieve financial security, it promotes not only economic participation in their community but generational knowledge as well.”

“There’s a case to start financial literacy education [as soon as possible],” added A.J. Jordan, Head of Community Stewardship at Vanguard, “because research shows that most habits around money are set in childhood. We believe that it’s important for children to begin learning core financial principles as early as they can to build positive financial habits for the rest of their lives.”

Company example: Vanguard’s My Classroom Economy

Vanguard started its classroom economy project after an employee’s 10-year-old son, a fourth grader, asked a seemingly simple question during dinner: “I wonder when I'll be able to pay off my mortgage?” Intrigued by the discovery that her son had a classroom mortgage and was earning a paycheck for his classroom job, the Vanguard crew member contacted her son’s teacher. The classroom economy idea offered a way to teach young people not only the concept of financial discipline but also—very importantly—the rewards that go with it.

Vanguard set out to build on those ideas and to make them available, free of charge, to teachers everywhere, knowing that the more help it could provide to educators, the more those educators could do to teach children financial skills that last a lifetime. Vanguard crew members (employees) were invited to donate their time and expertise to the project, and have done so enthusiastically. As a result, My Classroom Economy grew to over 150 Vanguard volunteers serving over 1.2 million students and counting.

So, what exactly is My Classroom Economy?

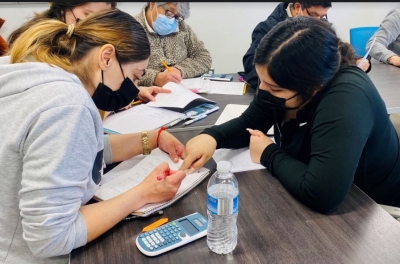

It’s a free, experiential, supplemental, and adaptive classroom management system that teaches students financial responsibility through real-world application (simulated microeconomy) while enabling teachers to reinforce positive behaviors and deter negative behaviors in their classroom. The program is designed to support students and teachers, from kindergarten through twelfth grade. My Classroom Economy supports financial wellbeing because it provides students hands-on experience with the basic financial concepts of earning, spending, saving, and more complex concepts over time.

The program is uniquely effective thanks to three key characteristics. Firstly, it’s experiential in nature. This means it allows students to learn by doing, which includes practicing behaviors related to financial responsibility and, yes, even making mistakes as they go. The program is also supplemental—designed to overlay and complement what teachers are already doing, as opposed to interrupting the existing curriculum. Finally, it’s adaptive. My Classroom Economy can be tailored to fit any grade and all different learning abilities. Teachers can customize the program to meet their unique classroom needs.

Beyond My Classroom Economy, Vanguard is committed to leveraging philanthropic resources and company expertise to create pathways to economic stability and mobility for youth and adult caregivers.

Vanguard’s Community Stewardship Team is embarking on a new strategic philanthropic focus on financial well-being. Through grantmaking and collaborative partnerships, the goal is to support community-based organizations that expand access to evidence-based programs that improve the economic outlook for historically marginalized individuals and communities. This portfolio will also work to strengthen the nonprofit financial ecosystem in key Vanguard markets.

Company example:

Lincoln Financial Foundation’s work to build financial literacy and wellness

Lincoln Financial partners with a number of financial health organizations that focus on helping individuals to broadly understand what it means to be financially secure through comprehensive financial coaching. To ensure its grantmaking is meeting the company mission and vision, leaders leverage data and research to understand community challenges and opportunities. They also use data to identify nonprofit partners who are delivering on measurable results in their communities. These organizations track progress on outcomes, use nationally recognized best practices and proven strategies, and strive to continually improve their service delivery and results.

At present, some of the organizations in this group include Local Initiatives Support Corporation (LISC) with their Financial Opportunity Centers in six cities throughout the country, and Clarifi’s Financial Empowerment Centers in Philadelphia. In addition to financial health programs to build financial empowerment and resilience, Lincoln Financial also supports workforce development programming aimed at upskilling, reskilling, and credentialing—to build sustainable career pathways. Partners in this area include Urban Leagues across six cities, and Congreso de Latinos Unidos in Philadelphia.

“Bright financial futures begin with strong foundations,” explained Wright. “To ensure students enter the workforce prepared for financial success, we also support Junior Achievement groups across our footprint to deliver age-appropriate, stackable financial literacy curriculum with hands-on simulations.”

Setting goals and measuring progress towards financial wellness

“We understand that everyone’s path to financial wellness is different, and our goal is to meet people where they are on their journey,” Wright shared. “For community impact, we work closely with our nonprofit partners to support programs that align with measurable outcomes that move the needle on an individual’s financial capability and resilience. Those include demonstrating knowledge of financial concepts, ability to meet day-to-day expenses, contributions to savings and increased credit score. We are proud that our nonprofit partners report that 81% of program participants in our financial health programming gained additional financial knowledge, resources or coaching to improve their financial resilience. Additionally, 77% of participants enrolled in workforce development programming gained the necessary skills and credentials to attain meaningful employment or advance their career.”

To help bring these stories and outcomes to life, Lincoln Financial partnered with its nonprofit grantees, highlighting the journeys of three individuals on their way to finance wellness. These stories are featured on the Foundation’s website.

For Vanguard, the results of its experiential learning tool are clear. To date, the My Classroom Economy program has been used by over 1.2 million students since its inception in 2011. Research from the University of Wisconsin’s Center for Financial Security revealed that students who participated in the program for 10 weeks improved financial knowledge and budgeting. The digital experience that launched in September of 2023 has reached approximately 7,500 students in all 50 states.

Beyond the study, Vanguard values the feedback from teachers to create an immersive and educational experience for students. Teacher feedback on both the paper and recent digital experience has been incredibly positive. Vanguard also values the impact reports that come straight from users, teachers, and administrators, including feedback like:

“Thank you so much for putting in all the work that has built the paper version of My Classroom Economy, and now the online version as well and for making it free for all to use! It has made the process so much easier for me to implement (tried building my own before and it took a lot of work).”

-An 8th grade gifted specialist

"As a first-year teacher, things can be overwhelming on the best days. This program is the linchpin of my classroom management system, and the free materials have saved me hours of time in preparing it."

-A 5th Grade Teacher

"I've used classroom economy for years and am LOVING the digital platform. I use a combination of paper and digital because kids love getting the cash in the moment when they do something extra, but I also love tracking fines digitally."

-A middle school teacher

Continue reading about financial literacy and related corporate social responsibility

To learn more about financial wellness programming for customers, employees, and communities, check out Lincoln Financial Group’s 2022 Corporate Social Responsibility Report.

My Classroom Economy, which launched its fully digital experience in September 2023, now helps teachers create a simulated economy for their classrooms in less than 15 minutes—something that took more than three hours using the paper kit. Learn more about this free, experiential learning tool here.

You can see where financial literacy ranks—among top social issues in community involvement programs—by reviewing BCCCC’s 2023 Community Involvement Report (full report accessible to BCCCC members only).

And if your company is looking for ways to build financial wellness and literacy among your stakeholders—by launching or improving initiatives with community organizations—consider taking a BCCCC course in Corporate Citizenship Partnership Management or Impact Measurement.

Related Content

RESEARCH BRIEF - Researchers investigated how ESG activities help or hurt financial performance, using nine years of data from over 1,200 global companies.

RESEARCH BRIEF - Researchers analyzed 4 US energy exchange-traded funds (ETFs) over 15 years, including 2 dirty energy funds tracking fossil fuel companies and 2 clean energy funds tracking renewable energy companies.

RESEARCH BRIEF - Researchers conducted a survey, which measured perceptions of CSR and ethical leadership within the manufacturing and service industries.

WEBINAR: This webinar explores how corporate giving will be reshaped by the One Big Beautiful Bill. Hear directly from corporate citizenship leaders as they share innovative, real-world strategies that deliver impact for communities and results for business.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.

This guidebook offers insights on placing employees in nonprofit board service roles.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.