WEBINAR: This webinar explores how to measure and communicate your organization's social impact with proven frameworks and strategies that matter to stakeholders.

Commitment to inclusion across markets

Pictured: Nasdaq's community involvement efforts in support of diversity, equity, and inclusion are amplified through the Nasdaq GoodWorks employee volunteer program.

This is an excerpt from the article “Diversity, equity, and inclusion across the workforce” from the Spring 2021 issue of the Corporate Citizen.

Read the full article

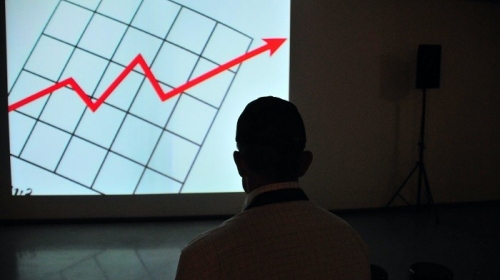

Inclusion and Stock Return

Research shows a consistently positive relationship between diversity, equity, and inclusion and financial performance. One recent study found that 20 of the most inclusive companies had an average annual stock return of 10% over five years, compared to 4.2% for the 20 least diverse companies.

As an exchange, Nasdaq aims to set the pace for rethinking capital markets and economies. This year, Nasdaq celebrates its 50th anniversary and remains deeply committed to long-term ESG advocacy, oversight, and philanthropy to engage with stakeholders at all levels. As the company has charted a path forward amid the COVID-19 pandemic, its leaders see an opportunity for listed companies to seize the moment to address the longstanding and systemic challenges that threaten our shared prosperity.

As such, Nasdaq champions inclusive growth and prosperity by powering stronger economies, creating more equitable opportunities, and contributing to a more sustainable world. To that end, the company has launched a new Purpose Initiative designed to support women and underrepresented minority communities with the resources needed to grow and sustain their businesses. The initiative comprises the company’s philanthropic, community outreach, corporate sustainability, and employee volunteerism programs, and leverages Nasdaq’s unique place at the center of capital creation, markets, and technology.

“Unequal participation in the markets is deepening the divide within our communities, and more needs to be done to level the playing field for entrepreneurs and investors of all ages, genders, and races,” said Adena Friedman, president and CEO of Nasdaq. “Because the capital markets can be a powerful vehicle for fostering new ideas in building a more inclusive economy and creating wealth, we are pledging to use our industry expertise, renewed sense of purpose, and philanthropic focus to advance investor engagement and provide increased support to minority and female entrepreneurs.”

Nasdaq GoodWorks

This rekindled sense of purpose is reflected in Nasdaq’s community involvement efforts. The company is renewing the mission of its Nasdaq Foundation to focus on reimagining investor engagement to equip underrepresented communities with the financial knowledge to share in the wealth that markets create. In the wake of the protests against racial inequality in June 2020, the company committed $3 million in cash donations to organizations providing critical assistance to communities disproportionately impacted by the global health, economic, and social justice crises. Nasdaq has also launched a Smart Investing portal to inform the general public on all elements of retail trading and investing, which the company believes will help to drive increased investor engagement from all ages, genders, and races. These community involvement efforts will be amplified through the Nasdaq GoodWorks employee volunteerism program and the Nasdaq Entrepreneurial Center, an independent 501(c)(3) organization committed to bringing access and equity to the global entrepreneurial ecosystem.

As part of its internal commitment, Nasdaq has increased investment in professional advancement and talent acquisition programs to foster a diverse and inclusive corporate culture. The company is focusing initially on enhancing its communication, training, development, professional advancement, and talent acquisition programs. Senior leaders have also partnered with the company’s GLOBE (Global Link of Black Employees) employee network—1 of 10 diversity and inclusion internal employee networks within Nasdaq—to identify and prioritize these efforts.

Finally, Nasdaq is using its influence to foster market-wide board diversity and transparency. In December of 2020, Nasdaq filed a proposal with the U.S. Securities and Exchange Commission (SEC) to adopt new listing rules related to board diversity and disclosure. If approved by the SEC, the new listing rules would require all companies listed on Nasdaq’s U.S. exchange to publicly disclose consistent, transparent diversity statistics regarding their board of directors. Additionally, the rules would require most Nasdaq-listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as a woman and one who self-identifies as either an underrepresented minority or LGBTQ+. Foreign companies and smaller reporting companies would have additional flexibility in satisfying this requirement with two female directors.

“Nasdaq’s purpose is to champion inclusive growth and prosperity to power stronger economies,” said Friedman. “Our goal with this proposal is to provide a transparent framework for Nasdaq-listed companies to present their board composition and diversity philosophy effectively to all stakeholders; we believe this listing rule is one step in a broader journey to achieve inclusive representation across corporate America.”

Related Content

RESEARCH BRIEF - Researchers investigated how ESG activities help or hurt financial performance, using nine years of data from over 1,200 global companies.

RESEARCH BRIEF - Researchers analyzed 4 US energy exchange-traded funds (ETFs) over 15 years, including 2 dirty energy funds tracking fossil fuel companies and 2 clean energy funds tracking renewable energy companies.

RESEARCH BRIEF - Researchers conducted a survey, which measured perceptions of CSR and ethical leadership within the manufacturing and service industries.

WEBINAR: This webinar explores how corporate giving will be reshaped by the One Big Beautiful Bill. Hear directly from corporate citizenship leaders as they share innovative, real-world strategies that deliver impact for communities and results for business.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.

This guidebook offers insights on placing employees in nonprofit board service roles.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.