WEBINAR: This webinar explores how to measure and communicate your organization's social impact with proven frameworks and strategies that matter to stakeholders.

Corporate citizenship in times of economic contraction

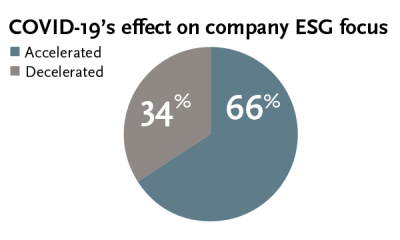

Research tells us that effective corporate citizenship programs mitigate risk, boost reputation, and serve the needs of a variety of stakeholders. During the Center’s recent conference breakout webinar, Constructive collaboration with investor relations, the majority of attendees reported that their companies are accelerating their focus on environmental, social, and governance (ESG) issues. (See figure at right.)

Because we are all experiencing such significant disruption, it is natural to want to protect the programs that we have taken such care—sometimes over the course of many years—to build. This is a time when we may need to try different approaches to our corporate citizenship programs.

Different contexts require different strategies. By taking a closer look at CSR during past recessions, we can derive some insight about how to make the most of our current operating environment. As always, empirical research guides the way:

Building trust with customers and with the general public is a significant motivator for corporate citizenship investments during times of recession. During the Great Recession, research confirmed that firms did not lessen their CSR investments overall, suggesting that they recognize the importance of CSR to maintaining trust and positive reputation.1 During the 2008–2009 financial crisis firms with better relationships with their numerous stakeholder groups, had stock returns that were four to seven percentage points higher than firms where trust was low and relationships were tenuous. High-CSR firms also experienced higher profitability, growth, and sales per employee relative to low-CSR firms, and they were able to raise more debt.2,3

Market studies observed that corporate communications related to corporate citizenship commitments were more frequent. For example, advertisements containing CSR messages increased during the last recession. During periods of economic decline, CSR messages were more likely to be integrated into “mainstream” advertising in addition to being communicated through vehicles such as sustainability reports.4

The mechanism behind how corporate citizenship creates value for companies in different types of economic cycles appears to be anchored not as much in whether the company remains profitable, but rather in how trustworthy and “risk-worthy” they are perceived to be. This is evidenced in multiple studies that observe that in high growth economic cycles, companies with fewer social concerns generally achieved higher profit; in economic downturns firms with higher CSR strengths outperformed their benchmarks.5,6

Taken together, these findings suggest that trust is an important outcome of corporate citizenship investments that build social capital. This accumulation is needed during boom times to attract talent to serve customers, and when companies experience external systemic shocks, the accumulated social capital may provide an insurance-like protection.

Consistent with these observations, in each of the Center’s last three State of Corporate Citizenship studies, respondents who have integrated corporate citizenship with their business strategy report better success in achieving important business objectives. (See figure below for responses from the 2020 report.)

During this time, when budgets may be challenged, think about how you can adjust your programs to focus on building social capital through employee support programs, volunteer efforts, and by developing the best possible environmental, social, and governance performance. Have you flipped operations from consumer goods to supplying healthcare? Tell that story. Are your people still reporting to work in essential roles? Tell the story of everyday heroes. Are your executives taking reductions in pay? Share the stories of leadership that happen every day in your company and be the beginning of what could be a virtuous cycle of trust that creates value and resilience for us all!

BCCCC is here to help. Do you have a question or research topic that we can help with? Email us at ccc@bc.edu. Want to connect with peers? Join the BCCCC Online Member Community or one of our upcoming Member Meetups. We look forward to connecting with you soon and to continuing to support your important work.

[1] Sakunasingha, B., Jiraporn, P., & Uyar, A. (2018). Which CSR activities are more consequential? Evidence from the great recession. Finance Research Letters, 27, 161-168.

[2] Seles, B. M. R. P., de Sousa Jabbour, A. B. L., Jabbour, C. J. C., & Jugend, D. (2018). In sickness and in health, in poverty and in wealth? Journal of Organizational Change Management.

[3] Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. The Journal of Finance, 72(4), 1785-1824.

[4] 9 Green, T., & Peloza, J. (2015). How did the recession change the communication of corporate social responsibility activities? Long Range Planning, 48(2), 108-122.

[5] Harrison, J. S., & Berman, S. L. (2016). Corporate social performance and economic cycles. Journal of Business Ethics, 138(2), 279-294.

[6] Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. The Journal of Finance, 72(4), 1785-1824.

Related Content

RESEARCH BRIEF - Researchers investigated how ESG activities help or hurt financial performance, using nine years of data from over 1,200 global companies.

RESEARCH BRIEF - Researchers analyzed 4 US energy exchange-traded funds (ETFs) over 15 years, including 2 dirty energy funds tracking fossil fuel companies and 2 clean energy funds tracking renewable energy companies.

RESEARCH BRIEF - Researchers conducted a survey, which measured perceptions of CSR and ethical leadership within the manufacturing and service industries.

WEBINAR: This webinar explores how corporate giving will be reshaped by the One Big Beautiful Bill. Hear directly from corporate citizenship leaders as they share innovative, real-world strategies that deliver impact for communities and results for business.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.

This guidebook offers insights on placing employees in nonprofit board service roles.

This study explores shifting trends in employee volunteering, corporate giving, and other means of corporate community involvement.