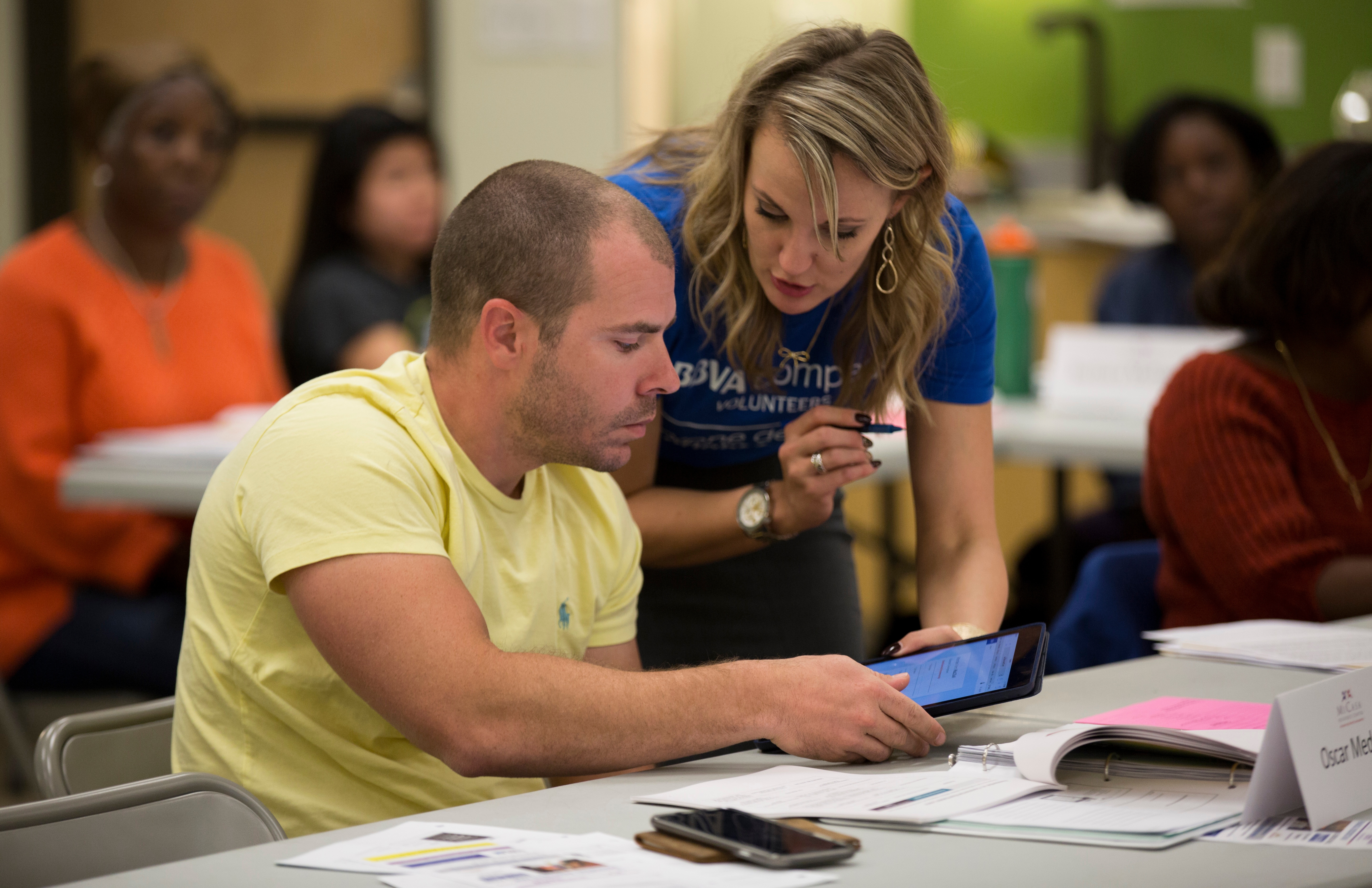

BBVA Compass relies on its bedrock principle of transparent banking to serve its clients, and invests significant time and money in its communities.

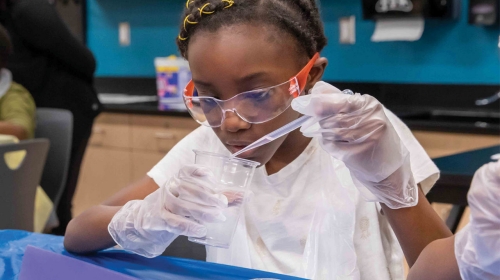

It is firmly committed to reaching low- to moderate-income (LMI) areas. Every initiative BBVA Compass undertakes, every program that it develops and supports—whether it’s community development, education, or the arts—is designed to underscore the bank’s brand promise of building better, brighter futures for everyone in its communities.

In November 2014, BBVA Compass pledged $11 billion in lending, investments, and services over the next five years toward supporting LMI individuals and neighborhoods. It also dramatically expanded the team involved in carrying out the bank’s pledge, and introduced its Home Ownership Made Easier (HOME) product for LMI homebuyers. These steps significantly elevated the bank’s commitment, and helped drive the improved performance of its Community Reinvestment Act (CRA) program. CRA was enacted by Congress in 1977 and is designed to encourage financial institutions to help meet the credit needs of the communities they serve, primarily in low- and moderate-income neighborhoods.

“We answered the call for an improved program to meet community-reinvestment goals,” said Reymundo Ocañas, director of corporate responsibility and reputation at BBVA Compass. “We built the infrastructure to support measurable community-development programs, and we added 20 staff members to help ensure that our work in the community has real impact.”

The new strategy was created with the active commitment of bank leadership at all levels, starting at the very top. BBVA Compass transitioned oversight of the CRA program to its Corporate Responsibility and Reputation department, which reports to the office of the CEO. From there, a dedicated team of 30 highly engaged employees operates the program. These professionals are armed with not only the motivation to create change, but with the tools to do so—including a new bank tool that identifies, qualifies, and tracks community-development lending, as well as service and investment activities. Their efforts are also informed by insights from a council of 19 community members.

“We realized that we needed help from community leaders outside BBVA Compass to make decisions that will truly meet the needs of families and small businesses in our neighborhoods,” said Ocañas. “We asked local and national leaders to be part of our new Community Advisory Board. This group is now helping to shape our community-investment strategies.”

This board has helped develop the many initiatives that power BBVA Compass’ five-year commitment, including its pledge to offer $2.1 billion in mortgage loans to LMI communities by 2020. Lending is executed primarily through its HOME program, which helps LMI borrowers cover down payment and closing costs. The program allows borrowers to finance up to 100 percent of a home’s value, with the bank contributing $4,500 toward certain closing costs.

“We’ve built a comprehensive program that will help many people across our footprint realize the dream of homeownership—something that may have seemed unattainable to them in the past,” said Eduardo Castañeda, director of real estate lending for BBVA Compass. “The financing and closing cost assistance, and the essential homebuyer education, will help ensure they enjoy the benefits of their new home for years to come.”

Through this initiative and many more, BBVA Compass has made significant investments in LMI areas. In just the first full year of the program, the bank dedicated more than $2.5 billion overall, with $819 million in mortgage loans to LMI households and areas, $1.1 billion in small-business loans, $457 million in community development lending, and $205 million in community development investments. It is also working to promote financial inclusion by advancing its digital technology solutions, offering LMI individuals access to banking options they might not otherwise have.

“BBVA Compass is a principled bank that is committed to building a better future for absolutely everyone in our communities—no exceptions,” said BBVA Compass Chairman and CEO Manolo Sánchez. “It’s good business sense, it’s responsible banking, and it helps us connect in a meaningful way to the places where we put down stakes. We are committed to doing our part in a way that’s as big as our vision for banking in the 21st century.”