Over the past year, the debate about what actions should be taken to halt climate change has continued in earnest. Involvement from experts, religious leaders, companies, activists, and consumers has reached a fever pitch, and governments have responded. The United States and China reached a historic agreement to curb emissions and promote renewable energy, which has led to advancements such as the Environmental Protection Agency’s Clean Power Plan, and the world’s largest cap and trade program. The United Nations is ramping up for COP21—the 21st Session of the United Nations Framework Convention on Climate Change—and has included climate change in its new Sustainable Development Goals (SDGs), which were accepted in late September by all 193 member states.

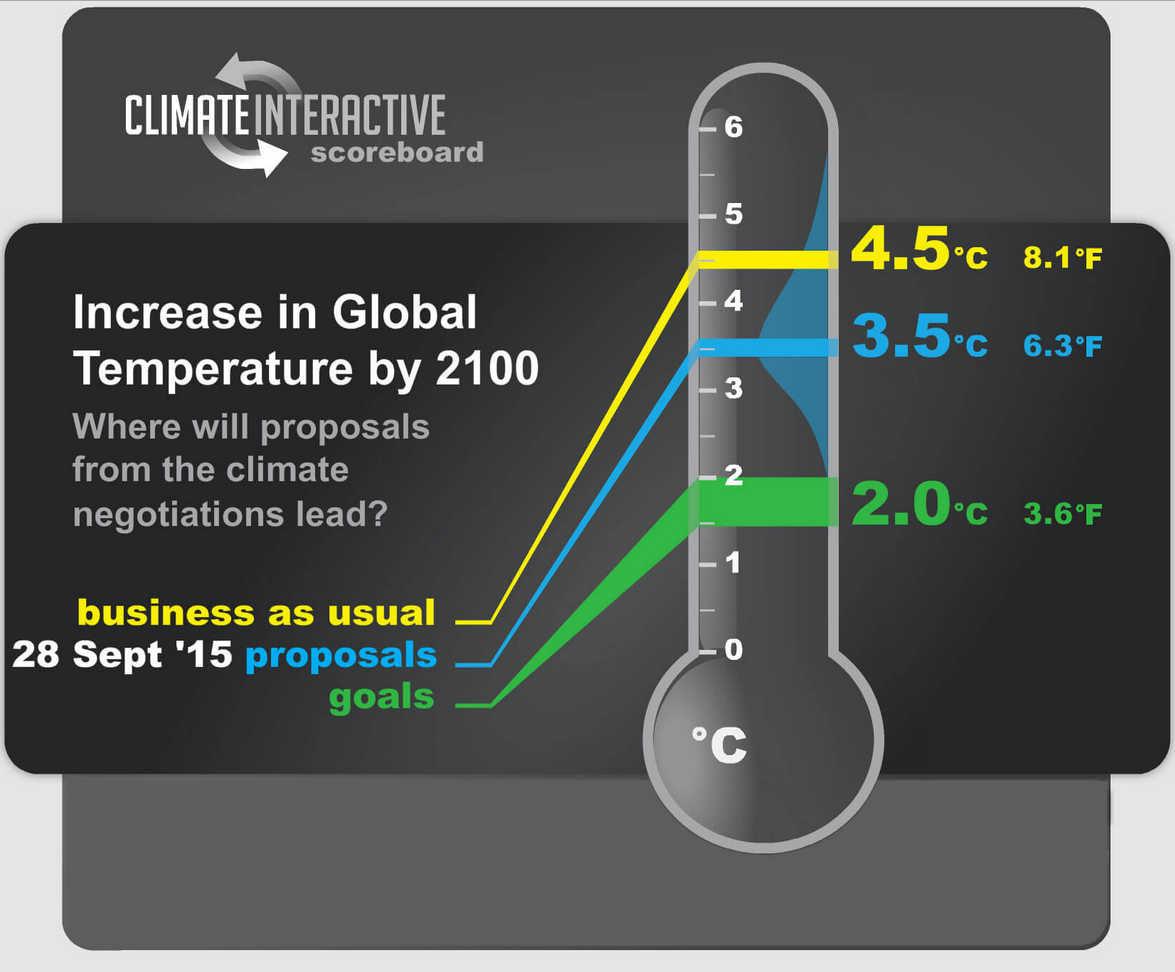

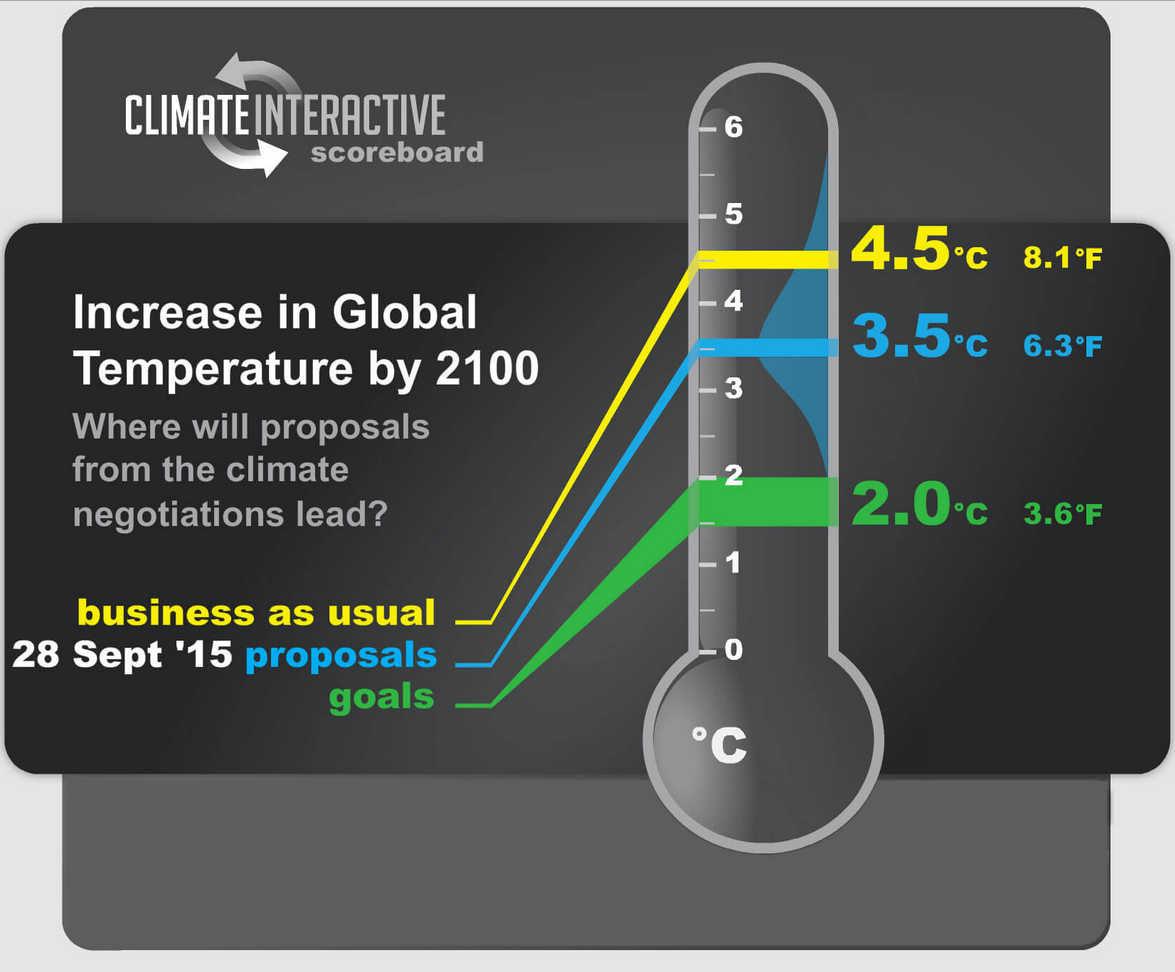

Yet, according to a new study released by Climate Interactive, the current climate commitments that our leaders have made will not be enough. Their analysis finds that if all of the climate pledges that had been made by September 28 are honored, the global temperature will increase by 3.5 degrees Celsius (6.3 degrees Fahrenheit) by 2100, considerably more than the 2 degrees C that experts agree is the limit to maintaining life on Earth as we know it.

Yet, according to a new study released by Climate Interactive, the current climate commitments that our leaders have made will not be enough. Their analysis finds that if all of the climate pledges that had been made by September 28 are honored, the global temperature will increase by 3.5 degrees Celsius (6.3 degrees Fahrenheit) by 2100, considerably more than the 2 degrees C that experts agree is the limit to maintaining life on Earth as we know it.

To truly ensure safe, healthy, and prosperous communities, the business community is going to have to step into the fight against climate change in a bigger way. Business leaders, including The Walt Disney Company, Xcel Energy, and Wells Fargo, are already working to establish discipline around natural capital pricing with internal chargebacks for emissions, not only because it is the right thing to do, but because—as President Barack Obama said during the United Nations Sustainable Development Summit—it is “one of the smartest investments we can make in our own future.”

Here at the Boston College Center for Corporate Citizenship, we’ve known for a long time that strong environmental performance and investments in greenhouse gas reduction and clean energy yield business value AND social value. We’ve read the research, such as a 2013 study which finds that the adoption of environmental management processes boosts market value, or a separate 2013 study that finds that the market penalizes firms for increases in carbon emissions. In this study, researchers found that, on average, firm value decreased by $212,000 for every additional thousand metric tons of carbon emissions reported. When you consider just how many thousands of tons many companies emit (the median of the 256 S&P firms that were studied was 1.07 million), companies that don’t invest in shrinking their carbon footprints may suffer serious financial ramifications.

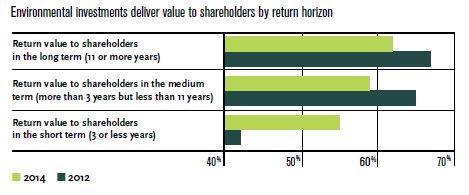

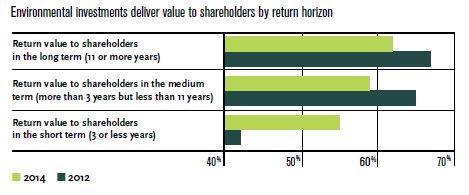

We also know that business leaders understand this relationship, as the majority of executives surveyed in the Center’s 2014 State of Corporate Citizenship reported that environmental investments delivered value over the short, medium, and long terms, and planned to increase resources for every listed environmental dimension, such as sustainable resource use and pollution prevention practices, over the next three years.

So it is no surprise to me when I find so many of the Center’s member companies in the news for taking bold and strategic action against climate change. Companies like Nike and Salesforce, which have committed to buying 100 percent of their energy from renewable sources, like UPS, that reached its carbon reduction target three years early, or like Microsoft, which has been carbon neutral since 2013. By taking steps now to limit their environmental impact and preserve our planet, these companies are leading the charge for a safe and sustainable future—one that promises to create the world we want to do business in, and the world we can live in.

Yet, according to a new study released by

Yet, according to a new study released by