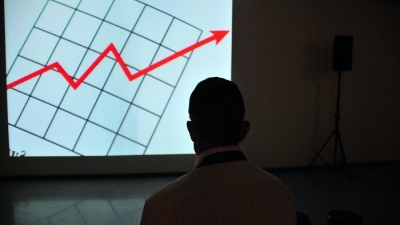

What drives success—financial or environmental performance? Research says both.

Takeaway: Strong environmental performance both stems from and results in strong financial performance, though focusing on outcome-based initiatives—such as carbon reduction efforts—will result in both market and accounting-based value-creation.

Suggested Audience: Top leaders, finance departments, corporate citizenship professionals, environmental managers

To determine the relationship between corporate environmental performance (CEP) and corporate financial performance (CFP)—and to better understand which is the chicken and which is the egg—researchers analyzed 149 empirical studies. They studied how both market- and accounting-based financial performance was affected by two types of environmental performance:

Process-based: internal efforts such as formal policies and environmental management systems.

Outcome-based: measurable efforts such as carbon reduction efforts or recycling programs.

They found that both of these practices were related to greater concurrent and subsequent financial performance—and that proactive efforts such as voluntary pollution practices made the greatest impact. They also found that strong accounting-based financial performance lead to an increased investment in process-based environmental performance.

Key findings:

- Firms that engage in process-based environmental efforts are likely to have stronger preceding and subsequent accounting-based financial performance.

- Companies that engage in outcome-based environmental efforts are likely to have stronger subsequent market-based AND accounting-based financial performance.

- Firms that have strong environmental performance (either process- or outcome-based) are also likely to have strong concurrent market-based and accounting-based financial performance.

- The positive relationship between environmental performance and financial performance is stronger when firms engage in proactive efforts such as voluntary pollution prevention practices, rather than reactive ones—such as regulation compliance.

If citing, please refer to original article: Endrikat, J., Guenther, E., & Hoppe, H. (2014). Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. European Management Journal, 32(5), 735-751.