REPORT - Survey results reveal this path to success in corporate social responsibility (CSR) and business success. Read the latest findings on how to create business AND social value.

Financial empowerment: A holistic approach

This is an excerpt from Issue 32 of the Corporate Citizen: Exploring New Perspectives.

Consumers expect companies to operate responsibly with respect to their stakeholders. In fact, recent research suggests that communication of corporate citizenship is a key advantage in efforts to retain customers.[1] To make the most of this competitive advantage, forward-thinking companies are creating social impact initiatives tailored to customer expectations to deepen brand loyalty. Umpqua Bank, for example creates long-term impact by helping customers connect to issues that they care about, such as education, equality, and inclusion.

Umpqua Bank is a financial services institution located in Portland, Oregon, that strives to create unique experiences for customers through personalized banking practices and lasting relationships. The bank’s motto, “We treat our customers like people,” illustrates its commitment to banking that fits into the bigger picture of a person’s life and financial health.

Over the years, Umpqua has become known for pushing the boundaries of what banking can and should be through its fundamental conviction that money is central to peoples’ lives and business. Umpqua takes seriously its responsibility to support both individual and community financial health, which are cornerstones of its corporate citizenship program.

At the heart of Umpqua’s approach is a holistic vision for corporate philanthropy that combines financial investment with deep bank resources and the unique expertise of its people. In 2019, for example, Umpqua launched a multi-year collaborative with four Portland-based nonprofits serving individuals and families along a spectrum of financial needs—from immediate financial support services and stable housing to post-secondary education and career readiness.

The formation of the collaborative was fueled by Umpqua’s drive to be a catalyst for stronger community partnerships that have greater, more sustained impact on a region. In addition to significant funding, Umpqua’s executive leadership team has convened collaborative learning sessions with the nonprofits’ leaders. Umpqua associates also continue to provide technical expertise, helping the nonprofits develop much-needed organizational and programmatic enhancements.

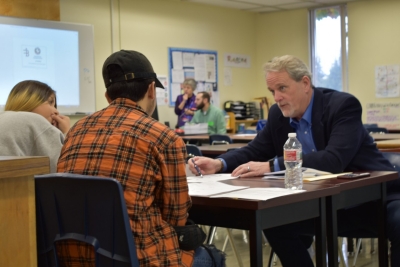

On the programmatic level, Umpqua’s focus on financial empowerment comes to life through literacy trainings addressing financial needs at all life stages. Initiatives start in schools with a curriculum that equips children from a young age with money management skills. They also include a variety of community touchpoints, including regularly scheduled “banker’s hours” at libraries, chambers of commerce, and other venues.

Recognizing that improved family financial health can help break cycles of poverty, Umpqua works with nonprofit partners to educate low-income families about access to economic benefits and opportunities widely available but often underutilized.

Education around the Earned Income Tax Credit (EITC) is good example. The EITC is an important but vastly underused anti-poverty tool that can significantly impact low-income working families’ financial prospects for the better. During tax season, Umpqua partners with a local nonprofit to help families understand and apply for the credit, which can reach $6,500 for a family with three or more children. Dozens of Umpqua financial experts have received significant training and volunteer weekly leading up to tax day to ensure filers receive the credit and to provide related money management tools.

Financial empowerment is even embedded into the development and design of new products and services. Umpqua recently launched Umpqua Go-To—a first of-its-kind digital banking platform that democratizes the concept of private banking. Through the Go-To app, every customer can choose a personal banker devoted to their financial needs. The goal is to empower deeper, more meaningful relationships with customers to ensure they’re receiving needed financial support.

Umpqua has also become a leading proponent for Individual Development Accounts (IDA), and is one of the few financial institutions to offer an IDA program that serves nonprofits and individual savers. IDAs are an essential asset-building tool, allowing individuals to grow their savings in pursuit of education, entrepreneurship, or home purchase goals. States like Oregon and California will generously match every dollar an accountholder puts into an IDA. IDAs are especially helpful to entrepreneurs and small business owners in underserved communities who need to fund their enterprise at the early stages. IDAs are paired with additional opportunities for financial and business education and assistance.

Umpqua’s approach to financial empowerment is centered on integration. It’s about community-led philanthropic engagement, financial literacy programs, and customer experience all working together in service of financially healthy customers and stronger, more prosperous communities.

Read more in Issue 32 of the Corporate Citizen: Exploring New Perspectives.

[1] Park, E., Kim, K. J., & Kwon, S. J. (2017). Corporate social responsibility as a determinant of consumer loyalty: An examination of ethical standard, satisfaction, and trust. Journal of Business Research, 76, 8-13.

Related Content

The U.S. Fish and Wildlife Service (FWS) and the National Marine Fisheries Service (NMFS) finalized a recent set of revisions to the Endangered Species Act that were rolled back under the previous presidential administration.

The United Nations (UN) General Assembly unanimously adopted the first global resolution on artificial intelligence (AI).

Spain’s Council of Ministers has approved a 5% increase in monthly minimum wage.

The California Department of Water Resources (DWR) released the California Water Plan Update 2023 (CWP 2023 Update) and calls the plan “A Roadmap to Water Management and Infrastructure for a Water Resilient Future.”

Wisconsin Governor Tony Evers signed into law the country’s third earned wage access (EWA) bill.

Not all communities have equal access to the hardware, connectivity, or digital literacy that is essential for learning and thriving in today’s society. This member meetup spotlights companies offering solutions.

WEBINAR: Re-watch this webinar to better understand your feelings of stress and/or burnout as a CSR professional, and to explore different strategies that may support you and your colleagues.